CDSL Share Price Target Tomorrow 2025 To 2030

CDSL (Central Depository Services Limited) is one of India’s leading securities depositories, providing electronic holding of shares and securities. It plays a crucial role in the Indian stock market by offering safe and efficient depository services. CDSL Share Price on NSE as of 12 March 2025 is 1,090.80 INR.

Current Market overview of CDSL Share Price

- Open: 1,111.80

- High: 1,118.45

- Low: 1,080.00

- Previous Close: 1,104.45

- Volume: 3,537,903

- Value (Lacs): 38,557.84

- VWAP: 1,093.42

- Mkt Cap (Rs. Cr.): 22,777

- Face Value: 10

- UC Limit: 1,214.85

- LC Limit: 994.00

- 52 Week High: 1,989.80

- 52 Week Low: 811.00

CDSL Share Price Target Tomorrow 2025 To 2030

| CDSL Share Price Target Years | CDSL Share Price |

| 2025 | INR 2000 |

| 2026 | INR 2200 |

| 2027 | INR 2400 |

| 2028 | INR 2600 |

| 2029 | INR 2800 |

| 2030 | INR 3000 |

CDSL Share Price Chart

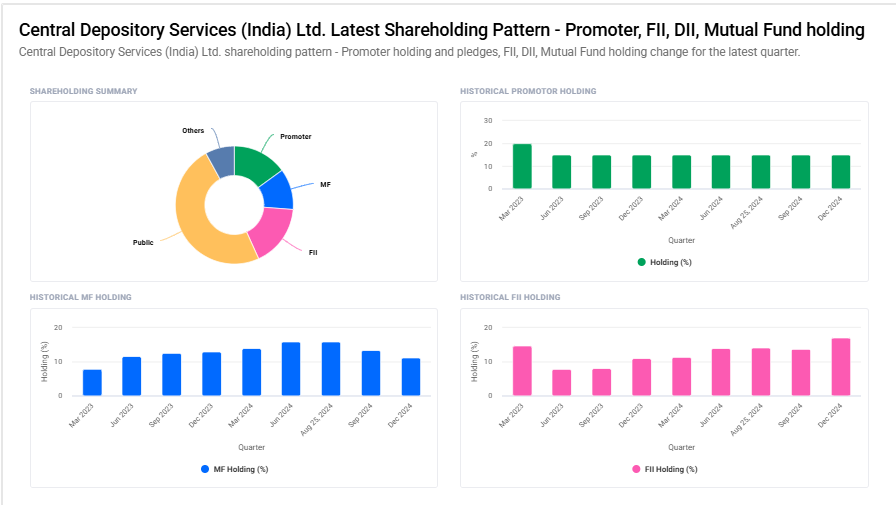

CDSL Shareholding Pattern

- Promoter: 0%

- FII: 27.1%

- DII: 25.3%

- Public: 47.6%

Key Factors Affecting CDSL Share Price Growth

-

Increase in Demat Accounts – With more retail investors participating in the stock market, the demand for depository services is rising. CDSL, being one of the leading depositories in India, benefits from this growth.

-

Stock Market Performance – A strong and growing stock market encourages more trading and investing activity, leading to higher revenues for CDSL from transaction fees and account maintenance charges.

-

Regulatory Support – SEBI and other financial regulators promoting digital financial services and stricter compliance rules enhance the importance of CDSL, which positively impacts its business.

-

Technological Advancements – The adoption of advanced technology, such as blockchain and automation, can improve efficiency, reduce costs, and enhance security, making CDSL’s services more attractive.

-

Monopoly-Like Position – Along with NSDL, CDSL operates in a duopoly market, ensuring a steady flow of revenue from demat account services and maintaining a strong market position.

-

Growth of IPOs and Mutual Funds – An increasing number of IPOs, mutual fund investments, and new securities being introduced create higher demand for depository services, boosting CDSL’s earnings.

-

Expansion into New Services – CDSL’s efforts to diversify into new financial services, such as e-KYC, digital document storage, and data analytics, can provide additional revenue streams and support long-term growth.

Risks and Challenges for CDSL Share Price

-

Regulatory Changes – Strict or unfavorable regulations from SEBI and other financial authorities could impact CDSL’s business operations, affecting revenue and profitability.

-

Dependence on Stock Market Growth – CDSL’s revenue is highly linked to stock market activity. A downturn in the market, reduced trading volumes, or fewer IPOs can slow its growth.

-

Competition from NSDL – Although CDSL operates in a duopoly, its competitor, NSDL, also has a strong market presence. Any competitive pricing or service advantages from NSDL could impact CDSL’s market share.

-

Cybersecurity Risks – Being a digital financial services provider, CDSL faces risks from cyberattacks, data breaches, and hacking, which can harm investor trust and lead to regulatory penalties.

-

Technology Upgrades and Maintenance Costs – Continuous investment in technology to ensure security and efficiency can be costly. Delays or failures in implementing new systems could impact business performance.

-

Dependence on Transaction Fees – A large portion of CDSL’s revenue comes from transaction and account maintenance fees. If trading activity slows down or brokerage firms negotiate lower fees, revenue may decline.

-

Operational Risks and System Downtime – Any technical glitches, system failures, or disruptions in services can lead to investor dissatisfaction, loss of business, and possible legal issues.

Read Also:- Hyundai Motor Share Price Target Tomorrow 2025 To 2030