Bajaj Housing Finance Share Price Target Tomorrow 2025 To 2030

Bajaj Housing Finance is a subsidiary of Bajaj Finance, specializing in home loans, loan against property, and real estate financing. It plays a key role in India’s growing housing sector, benefiting from rising demand for affordable and premium housing. The company’s strong financial backing, competitive interest rates, and customer-friendly services make it a preferred choice among borrowers. Bajaj Housing Finance Share Price on NSE as of 12 March 2025 is 115.89 INR.

Current Market overview of Bajaj Housing Finance Share Price

- Open: 114.00

- High: 116.38

- Low: 113.50

- Previous Close: 113.51

- Volume: 6,512,220

- Value (Lacs): 7,547.01

- VWAP: 114.82

- Mkt Cap (Rs. Cr.): 96,514

- Face Value: 10

- UC Limit: 124.86

- LC Limit: 102.15

- 52 Week High: 188.50

- 52 Week Low: 103.10

Bajaj Housing Finance Share Price Target Tomorrow 2025 To 2030

| Bajaj Housing Finance Share Price Target Years | Bajaj Housing Finance Share Price |

| 2025 | INR 190 |

| 2026 | INR 230 |

| 2027 | INR 270 |

| 2028 | INR 300 |

| 2029 | INR 340 |

| 2030 | INR 370 |

Bajaj Housing Finance Share Price Chart

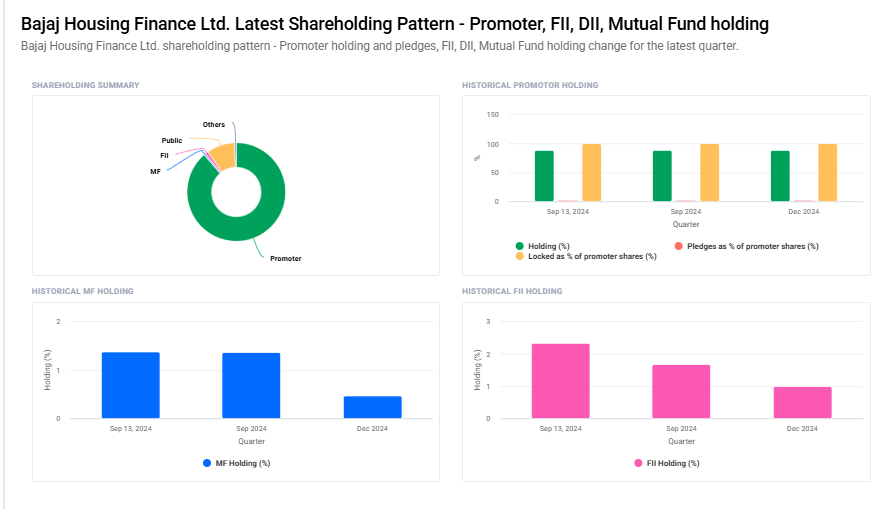

Bajaj Housing Finance Shareholding Pattern

- Promoter: 88.8%

- FII: 1%

- DII: 0.9%

- Public: 9.3%

Key Factors Affecting Bajaj Housing Finance Share Price Growth

-

Growth in the Housing Sector

The increasing demand for housing, driven by urbanization and rising income levels, directly impacts Bajaj Housing Finance. A strong real estate market boosts loan disbursements, positively influencing the company’s financial growth and share price. -

Interest Rate Trends

Lower interest rates make home loans more affordable, leading to higher borrowing and business expansion. If the Reserve Bank of India (RBI) keeps rates favorable, it could support Bajaj Housing Finance’s revenue growth. -

Strong Parent Company (Bajaj Group)

Being part of the Bajaj Group, which has a solid financial foundation and brand reputation, strengthens investor confidence. This backing provides stability, helping the company navigate market fluctuations effectively. -

Loan Portfolio Expansion

The company’s ability to grow its loan book by offering competitive mortgage products, home loans, and loan-against-property options can drive revenue growth. Expanding into new cities and regions also adds to future earnings potential. -

Asset Quality and NPA Levels

Maintaining low non-performing assets (NPAs) ensures financial stability. If Bajaj Housing Finance successfully manages credit risk and loan recoveries, it can boost profitability and investor trust. -

Government Policies and Real Estate Reforms

Policies such as interest subsidies, affordable housing schemes, and tax benefits for homebuyers encourage more borrowing. Positive regulatory developments in the housing finance sector can enhance the company’s business prospects. -

Technological Advancements and Digital Lending

The use of digital platforms for loan approvals, credit assessment, and customer service can improve efficiency and attract more customers. A strong tech-driven approach gives Bajaj Housing Finance a competitive edge, influencing its share price positively.

Risks and Challenges for Bajaj Housing Finance Share Price

-

Interest Rate Hikes

If the Reserve Bank of India (RBI) increases interest rates, borrowing becomes expensive for homebuyers. This could reduce loan demand, slow down business growth, and impact Bajaj Housing Finance’s revenue and share price. -

Economic Slowdown

A weak economy can lead to lower disposable income and job losses, making it harder for borrowers to repay loans. This could increase non-performing assets (NPAs), affecting the company’s profitability and investor confidence. -

Rising Competition in the Housing Finance Sector

The housing finance market is highly competitive, with banks and NBFCs offering similar loan products. If Bajaj Housing Finance fails to maintain competitive interest rates and customer service, it may lose market share, impacting its stock value. -

Regulatory and Policy Changes

Stricter RBI norms on lending, taxation changes, or government policy shifts in the real estate sector can impact business operations. Compliance with new regulations may increase costs or limit loan growth. -

High Dependence on the Real Estate Market

A slowdown in the real estate sector due to low demand, rising property prices, or delays in project approvals can reduce the demand for housing loans. This could negatively affect the company’s earnings and stock performance. -

Credit Risk and Default Rates

If borrowers face financial difficulties and default on their loans, the company may struggle with high NPAs. Poor asset quality can reduce investor trust and put pressure on the share price. -

Global Economic Uncertainty

Factors like inflation, geopolitical tensions, or financial crises in global markets can impact India’s economy and investor sentiment. Uncertainty in financial markets can lead to stock volatility, affecting Bajaj Housing Finance’s share price.

Read Also:- Adani Wilmar Share Price Target Tomorrow 2025 To 2030