Alok Industries Share Price Target Tomorrow 2025 To 2030

Alok Industries Share represents a well-known textile company in India, primarily engaged in manufacturing fabrics, garments, and home textiles. The company is backed by Reliance Industries, which has helped in its financial restructuring and revival. Alok Industries benefits from India’s strong textile demand and export opportunities, but it also faces challenges like high debt, raw material price fluctuations, and intense competition. Alok Industries Share Price on NSE as of 13 March 2025 is 15.92 INR.

Current Market overview of Alok Industries Share Price

- Open: 16.27

- High: 16.48

- Low: 15.85

- Previous Close: 16.19

- Volume: 3,534,383

- Value (Lacs): 563.03

- VWAP: 16.10

- Mkt Cap (Rs. Cr.): 7,909

- Face Value: 1

- UC Limit: 19.42

- LC Limit: 12.95

- 52 Week High: 30.00

- 52 Week Low: 14.50

Alok Industries Share Price Target Tomorrow 2025 To 2030

| Alok Industries Share Price Target Years | Alok Industries Share Price |

| 2025 | INR 30 |

| 2026 | INR 40 |

| 2027 | INR 50 |

| 2028 | INR 60 |

| 2029 | INR 70 |

| 2030 | INR 80 |

Alok Industries Share Price Chart

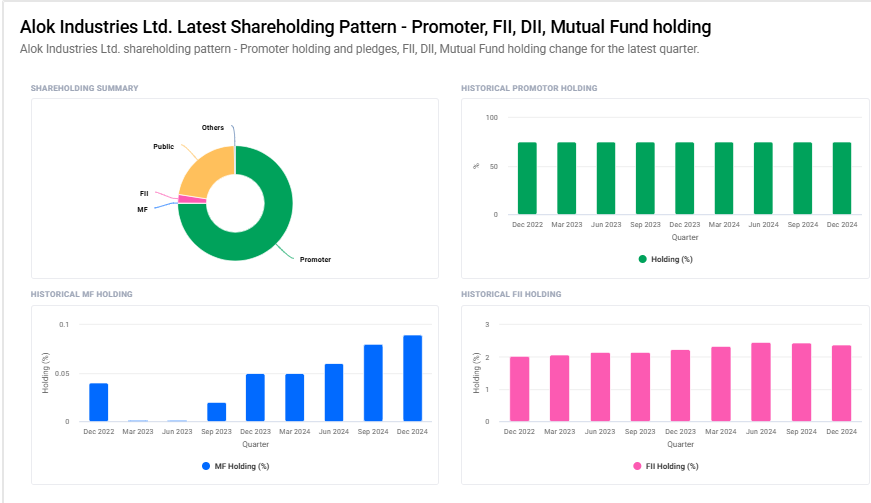

Alok Industries Shareholding Pattern

- Promoter: 75%

- FII: 2.4%

- DII: 0.4%

- Public: 22.2%

Key Factors Affecting Alok Industries Share Price Growth

-

Rising Demand for Textiles – As the global and domestic textile industry expands, Alok Industries, being a key player in fabric and garment manufacturing, stands to benefit from increased demand. Growth in retail and e-commerce also supports this demand.

-

Reliance Industries’ Support – After being acquired by Reliance Industries and JM Financial, Alok Industries has seen financial and operational improvements. Reliance’s strong backing provides stability and potential for future growth.

-

Export Market Expansion – Alok Industries exports to several international markets. If global demand for textiles and fabrics rises, especially in the U.S. and Europe, it could positively impact the company’s revenue and share price.

-

Government Policies and Incentives – Supportive policies like the Production-Linked Incentive (PLI) scheme and subsidies for the textile sector can boost Alok Industries’ growth, making it more competitive in the global market.

-

Operational and Debt Restructuring – The company has undergone financial restructuring, reducing its debt burden. Improved financial health can attract investors and enhance share price performance.

-

Cost Efficiency and Production Scale – Alok Industries benefits from large-scale production and integrated manufacturing, which helps lower costs. Efficient cost management can improve profit margins and support share price growth.

-

Consumer Preference for Indian Textiles – With a shift towards sustainable and high-quality textiles, Alok Industries can gain from the growing demand for Indian-made fabrics. Expanding into eco-friendly textiles could further strengthen its market position.

Risks and Challenges for Alok Industries Share Price

-

High Debt Burden – Despite financial restructuring, Alok Industries still carries a significant debt. High interest payments and repayment obligations could impact profitability and limit future growth.

-

Competitive Textile Industry – The textile sector is highly competitive, with strong domestic and international players. To maintain its market share, Alok Industries must consistently innovate and control costs, which can be challenging.

-

Raw Material Price Fluctuations – The company relies on cotton, polyester, and other raw materials. Any increase in raw material costs due to inflation, supply chain issues, or international market changes can hurt profit margins.

-

Global Economic Conditions – Alok Industries exports a substantial portion of its products. Economic slowdowns, recession risks, or changes in trade policies in key markets like the U.S. and Europe could reduce demand and affect revenue.

-

Regulatory and Policy Risks – Changes in government policies related to the textile sector, labor laws, or environmental regulations may increase compliance costs and operational challenges for the company.

-

Slow Recovery from Past Financial Issues – Alok Industries faced financial struggles before being taken over by Reliance Industries. Although improvements have been made, investors may remain cautious until the company demonstrates consistent profitability.

-

Stock Market Volatility – Like all stocks, Alok Industries’ share price is affected by market sentiment, investor confidence, and broader economic factors. Sudden changes in market trends or negative news could lead to stock price fluctuations.

Read Also:- Hyundai Motor Share Price Target Tomorrow 2025 To 2030