Adani Wilmar Share Price Target Tomorrow 2025 To 2030

Adani Wilmar is a leading Indian FMCG company known for its popular edible oil brand, Fortune. It is a joint venture between the Adani Group and Wilmar International, focusing on edible oils, packaged foods, and essential household products. The company has a strong presence in India’s food industry, offering products like rice, wheat flour, pulses, and ready-to-cook items. Adani Wilmar Share Price on NSE as of 11 March 2025 is 253.64 INR.

Current Market overview of Adani Wilmar Share Price

- Open: 249.00

- High: 258.70

- Low: 248.92

- Previous Close: 252.42

- Volume: 1,681,174

- Value (Lacs): 4,268.50

- VWAP: 253.68

- Mkt Cap (Rs. Cr.): 32,998

- Face Value: 1

- UC Limit: 277.66

- LC Limit: 227.17

- 52 Week High: 403.95

- 52 Week Low: 231.55

Adani Wilmar Share Price Target Tomorrow 2025 To 2030

| Adani Wilmar Share Price Target Years | Adani Wilmar Share Price |

| 2025 | ₹405 |

| 2026 | ₹430 |

| 2027 | ₹460 |

| 2028 | ₹490 |

| 2029 | ₹520 |

| 2030 | ₹550 |

Adani Wilmar Share Price Chart

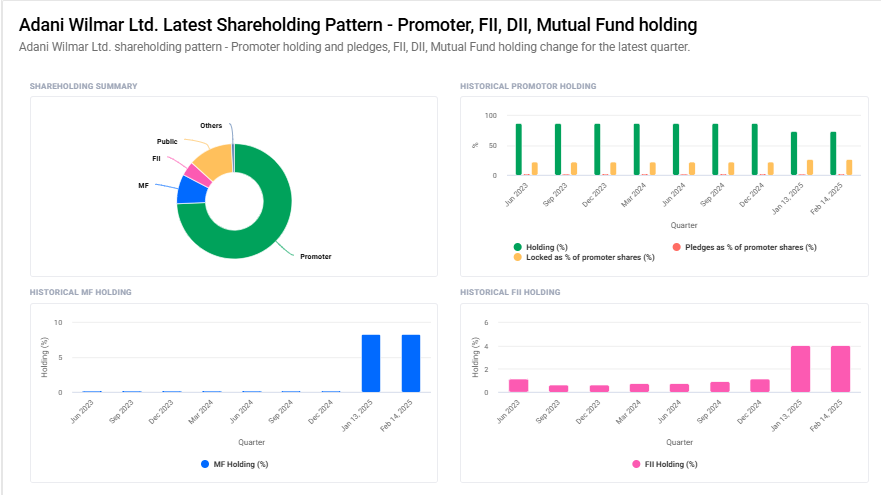

Adani Wilmar Shareholding Pattern

- Promoter: 74.4%

- FII: 4.1%

- DII: 8.8%

- Public: 12.9%

Key Factors Affecting Adani Wilmar Share Price Growth

Here are seven key factors affecting Adani Wilmar share price growth:

-

Rising Demand for Edible Oils and FMCG Products – As a major player in India’s edible oil and food industry, increasing consumer demand for healthy cooking oils and packaged foods can drive revenue growth and positively impact the share price.

-

Expansion of Product Portfolio – Adani Wilmar is diversifying into new food segments like rice, wheat flour, and ready-to-cook products. A strong and diverse portfolio can attract more customers and boost sales.

-

Strong Distribution Network – The company has an extensive supply chain across urban and rural markets. Continued expansion in untapped regions can strengthen its market position and revenue potential.

-

Global Commodity Prices and Raw Material Costs – Prices of palm oil, soybean oil, and other raw materials impact production costs. Favorable commodity prices can improve profit margins and investor confidence.

-

Brand Strength and Market Leadership – Adani Wilmar’s flagship brand, Fortune, is a well-recognized name in the Indian market. Strong brand loyalty and customer trust contribute to consistent revenue growth.

-

Government Policies and Import Duties – The edible oil industry is influenced by government regulations, import duties, and trade policies. Supportive policies can benefit Adani Wilmar, while unfavorable regulations may pose challenges.

-

Stock Market Trends and Investor Sentiment – Positive financial performance, industry growth, and favorable economic conditions can enhance investor confidence, leading to an increase in Adani Wilmar’s share price.

Risks and Challenges for Adani Wilmar Share Price

Here are seven key risks and challenges for Adani Wilmar share price:

-

Fluctuations in Commodity Prices – Adani Wilmar depends on raw materials like palm oil, soybean oil, and wheat. Any rise in global commodity prices can increase production costs and impact profit margins.

-

Regulatory and Policy Changes – Government policies on import duties, taxes, and food safety regulations can affect the company’s operations. Sudden changes in import restrictions or price caps may impact profitability.

-

High Competition in the FMCG Sector – The company faces competition from established brands like ITC, HUL, and Patanjali. Intense price wars and consumer preferences can limit market share growth.

-

Supply Chain and Logistics Challenges – Delays in raw material imports, transportation costs, or disruptions in distribution networks can affect the availability of products and overall sales performance.

-

Economic Slowdown and Consumer Spending – If inflation rises or economic conditions weaken, consumers may reduce spending on premium products, impacting sales and revenue growth.

-

Quality and Health Concerns – With increasing health awareness, consumers are shifting toward organic and healthier alternatives. Any negative reports about product quality can affect brand reputation and sales.

-

Stock Market Volatility and Investor Perception – Global economic uncertainty, company performance, or negative news about the Adani Group can influence investor sentiment, leading to fluctuations in Adani Wilmar’s share price.

Read Also:- Rattanindia Power Share Price Target Tomorrow 2025 To 2030