Adani Energy Solution Share Price Target Tomorrow 2025 To 2030

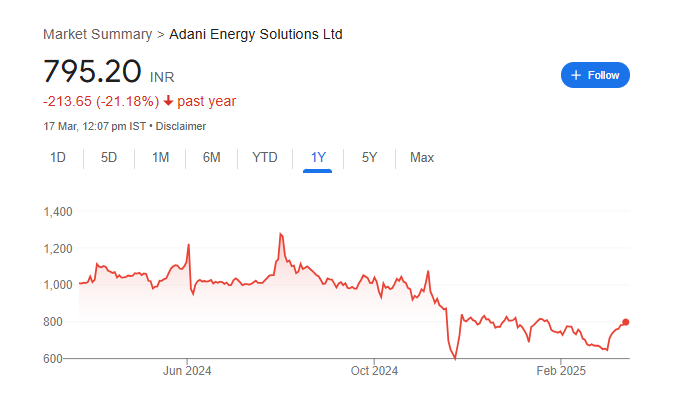

Adani Energy Solution is a key player in India’s power transmission and distribution sector. The company focuses on building and operating energy infrastructure, ensuring a steady supply of electricity across regions. It is part of the Adani Group and plays a vital role in India’s energy transition, including renewable power integration. The stock attracts investors due to its large-scale projects, growth potential, and strong market presence. Adani Energy Solution Share Price on NSE as of 17 March 2025 is 795.20 INR.

Current Market overview of Adani Energy Solution Share Price

- Open 779.80

- High 801.15

- Low 776.80

- Previous Close 783.20

- Volume 1,110,283

- Value (Lacs) 8,828.42

- VWAP 794.26

- Mkt Cap (Rs. Cr.) 95,519

- Face Value 10

- UC Limit 861.50

- LC Limit 704.90

- 52 Week High 1,348.00

- 52 Week Low 588.00

Adani Energy Solution Share Price Target Tomorrow 2025 To 2030

| Adani Energy Solution Share Price Target Years | Adani Energy Solution Share Price |

| 2025 | INR 1350 |

| 2026 | INR 1564 |

| 2027 | INR 1840 |

| 2028 | INR 2055 |

| 2029 | INR 2270 |

| 2030 | INR 2500 |

Adani Energy Solution Share Price Chart

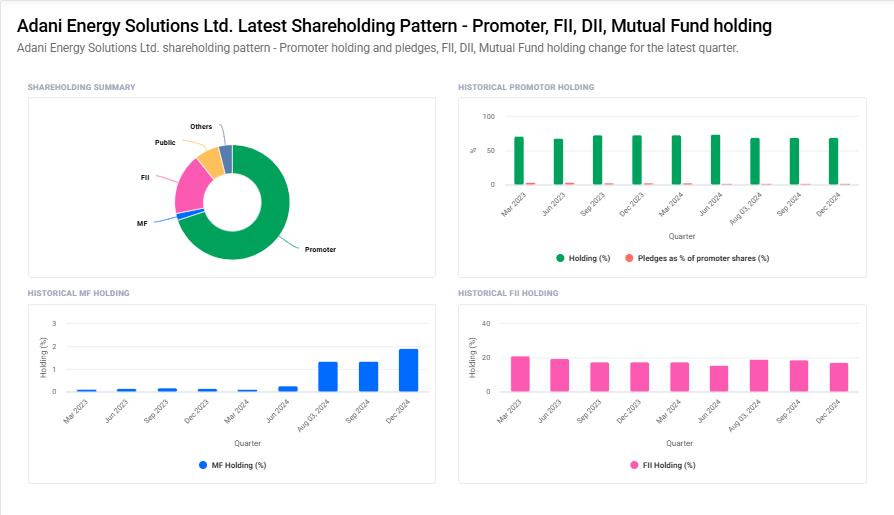

Adani Energy Solution Shareholding Pattern

- Promoter: 69.9%

- FII: 17.3%

- DII: 5.9%

- Public: 6.9%

Key Factors Affecting Adani Energy Solution Share Price Growth

-

Expansion in Renewable Energy

Adani Energy Solutions is focusing on renewable energy projects, including solar and wind power. The company’s expansion in green energy can boost investor confidence and drive share price growth. -

Government Policies & Regulations

Supportive government policies, incentives for renewable energy, and infrastructure development play a key role in the company’s growth. Any positive regulatory changes can benefit the stock price. -

Power Demand & Consumption Growth

With rising electricity demand in India, Adani Energy’s transmission and distribution projects can contribute to steady revenue growth, positively impacting its share price. -

Financial Performance & Debt Management

Strong financial results, including revenue growth and profitability, can attract investors. Effective debt management and maintaining a healthy balance sheet are crucial for long-term stock performance. -

Strategic Partnerships & Acquisitions

Collaborations with global energy companies, new projects, and acquisitions can enhance the company’s market position, leading to increased investor confidence and stock price appreciation. -

Market Sentiment & Economic Conditions

The overall economic environment, stock market trends, and investor sentiment toward the energy sector can impact Adani Energy’s share price growth. Positive market conditions can push the stock higher. -

Infrastructure & Technological Advancements

Investing in advanced technology and upgrading infrastructure for energy transmission and distribution can improve efficiency, attract investors, and support long-term growth in share value.

Risks and Challenges for Adani Energy Solution Share Price

-

Regulatory & Policy Risks

Changes in government policies, environmental regulations, or energy tariffs can impact the company’s operations. Stricter rules on renewable energy projects or transmission charges may slow growth and affect stock performance. -

High Debt Levels

Adani Energy Solution has invested heavily in infrastructure and energy projects, leading to significant debt. If the company struggles with repayments or rising interest costs, it could affect profitability and investor confidence. -

Market Volatility & Economic Conditions

Stock markets can be unpredictable, and economic downturns or global financial crises can impact investor sentiment. If economic conditions worsen, the company’s share price may face downward pressure. -

Competition in the Energy Sector

The power sector in India is highly competitive, with both private and government players. If competitors offer better pricing, efficiency, or innovation, it could limit Adani Energy’s market share and stock growth potential. -

Dependence on Infrastructure Projects

The company’s revenue heavily relies on large-scale infrastructure and energy transmission projects. Delays in project execution due to funding issues, regulatory hurdles, or logistical challenges can negatively impact growth. -

Fluctuations in Energy Prices

Variations in electricity prices, fuel costs, and global energy trends can impact Adani Energy Solution’s revenue and profitability. If energy prices decline, the company’s earnings may be affected, leading to stock volatility. -

Legal & Environmental Concerns

Large infrastructure projects often face legal challenges, land acquisition disputes, and environmental concerns. Any legal battles or negative publicity could hurt investor sentiment and impact the stock’s performance.

Read Also:- IndusInd Bank Share Price Target Tomorrow 2025 To 2030