NMDC Share Price Target Tomorrow 2025 To 2030

NMDC Limited is a leading government-owned mining company in India, primarily engaged in iron ore production. Its share price is influenced by global iron ore demand, steel industry growth, and government policies. Being a key supplier of raw materials for steel production, NMDC benefits from infrastructure development and industrial expansion. NMDC Share Price on NSE as of 21 March 2025 is 67.23 INR.

Current Market overview of NMDC Share Price

- Open: 66.64

- High: 67.60

- Low: 66.16

- Previous Close: 68.79

- Volume: 15,147,608

- Value (Lacs): 10,180.71

- VWAP: 66.96

- Mkt Cap (Rs. Cr.): 59,089

- Face Value: 1

- UC Limit: 73.13

- LC Limit: 59.84

- 52 Week High: 95.45

- 52 Week Low: 59.70

NMDC Share Price Target Tomorrow 2025 To 2030

| NMDC Share Price Target Years | NMDC Share Price |

| 2025 | INR 1o0 |

| 2026 | INR 120 |

| 2027 | INR 140 |

| 2028 | INR 160 |

| 2029 | INR 180 |

| 2030 | INR 200 |

NMDC Share Price Chart

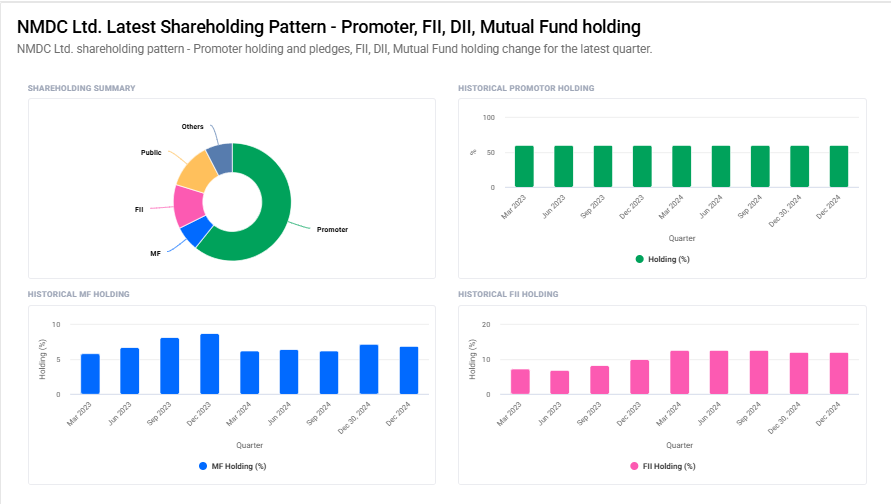

NMDC Shareholding Pattern

- Promoter: 60.8%

- FII: 12.1%

- DII: 14.5%

- Public: 12.6%

Key Factors Affecting NMDC Share Price Growth

-

Iron Ore Prices – NMDC’s revenue depends on iron ore prices. If global and domestic iron ore prices rise, the company earns more, positively impacting its share price. A decline in prices, however, can slow growth.

-

Production and Sales Growth – Higher production and sales volumes lead to better revenue and profitability. If NMDC increases its mining capacity and sells more iron ore, the share price may see upward movement.

-

Government Policies – As a public sector company, NMDC is influenced by government decisions, such as mining regulations, export policies, and royalty rates. Favorable policies can boost the stock, while restrictive policies may slow growth.

-

Infrastructure and Steel Demand – NMDC supplies iron ore to the steel industry. Rising demand for steel in construction, infrastructure, and manufacturing sectors increases demand for NMDC’s products, supporting share price growth.

-

Expansion and New Projects – Investments in new mines, modernization, and international projects help NMDC grow. Any positive developments in expansion plans can attract investors and push the share price higher.

-

Global Economic Trends – Economic growth, especially in countries like China and India, impacts demand for iron ore. A strong global economy supports NMDC’s growth, while economic slowdowns can affect sales.

-

Dividend and Financial Performance – Investors look at NMDC’s profitability, dividends, and financial health. Strong earnings and good dividend payouts make the stock attractive, leading to positive share price movements.

Risks and Challenges for NMDC Share Price

-

Fluctuating Iron Ore Prices – NMDC’s revenue depends on iron ore prices, which are highly volatile. A drop in global or domestic prices due to weak demand or oversupply can negatively impact the company’s earnings and share price.

-

Government Regulations and Policies – As a public sector enterprise, NMDC is subject to government rules on mining, export restrictions, and royalty payments. Any unfavorable policy changes could increase costs or limit growth opportunities, affecting investor sentiment.

-

Global Economic Slowdown – If the global economy slows down, steel demand declines, reducing the need for iron ore. This could hurt NMDC’s sales and put downward pressure on its stock price.

-

Competition in the Mining Sector – The entry of private players and international mining giants into the Indian market could increase competition, potentially affecting NMDC’s market share and pricing power.

-

Environmental and Legal Issues – Mining operations face environmental regulations and legal challenges, such as land acquisition disputes and environmental clearances. Delays in approvals or lawsuits can slow production and impact revenue.

-

Operational Risks and Infrastructure Challenges – NMDC operates large mines that require efficient logistics and infrastructure. Any disruptions due to accidents, transportation bottlenecks, or equipment failures could reduce productivity and affect stock performance.

-

Dependence on the Steel Industry – NMDC’s primary customers are steel manufacturers. If the steel industry faces a slowdown or reduced profitability, it could lead to lower iron ore demand, directly affecting NMDC’s financial performance and share price.

Read Also:- RVNL Share Price Target Tomorrow 2025 To 2030