LIC Share Price Target Tomorrow 2025 To 2030

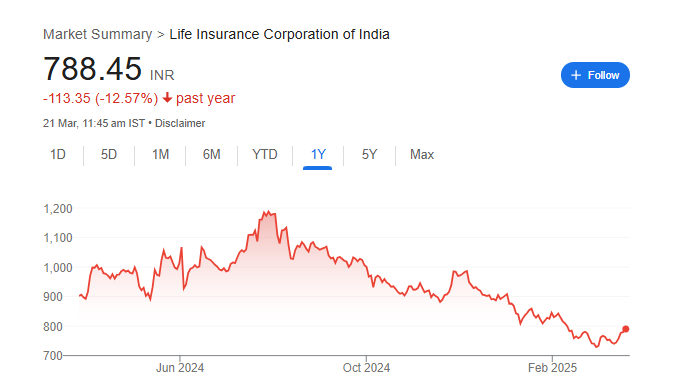

LIC (Life Insurance Corporation of India) is India’s largest and most trusted life insurance company. It is a government-backed company known for its strong market presence and massive customer base. LIC shares were listed on the stock market in 2022, making it one of the biggest IPOs in India. The company earns revenue from selling life insurance policies and investing in stocks, bonds, and government securities. LIC Share Price on NSE as of 21 March 2025 is 788.45 INR.

Current Market overview of LIC Share Price

- Open: 784.60

- High: 792.90

- Low: 779.50

- Previous Close: 779.50

- Volume: 761,074

- Value (Lacs): 6,004.11

- VWAP: 788.46

- Mkt Cap (Rs. Cr.): 498,979

- Face Value: 10

- UC Limit: 857.45

- LC Limit: 701.55

- 52 Week High: 1,222.00

- 52 Week Low: 715.30

LIC Share Price Target Tomorrow 2025 To 2030

| LIC Share Price Target Years | LIC Share Price |

| 2025 | INR 1230 |

| 2026 | INR 1400 |

| 2027 | INR 1550 |

| 2028 | INR 1700 |

| 2029 | INR 1850 |

| 2030 | INR 2000 |

LIC Share Price Chart

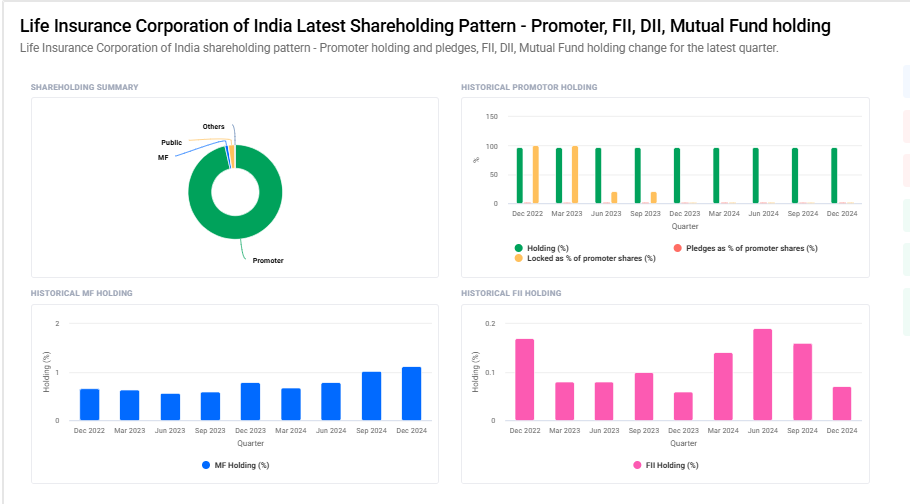

LIC Shareholding Pattern

- Promoter: 96.5%

- FII: 0.1%

- DII: 1.2%

- Public: 2.2%

Key Factors Affecting LIC Share Price Growth

-

Insurance Market Growth

LIC’s share price is influenced by the expansion of the insurance sector in India. With increasing awareness about financial security, more people are opting for life insurance, which boosts LIC’s premium collection and overall business growth. -

Government Policies and Regulations

Since LIC is a government-backed company, any policy changes related to insurance regulations, taxation, or investment norms can impact its profitability and, in turn, its share price. -

Investment Performance

LIC invests heavily in stocks, bonds, and government securities. The returns on these investments directly affect the company’s earnings, making stock market trends a crucial factor in its share price movement. -

Market Competition

Private insurance companies like HDFC Life and SBI Life are strong competitors. If LIC successfully maintains its market dominance and customer trust, it can positively impact its share price growth. -

Economic Conditions

Economic stability, inflation rates, and interest rates influence LIC’s investment returns and policy sales. A growing economy leads to better earnings and higher investor confidence in LIC shares. -

Financial Performance and Profitability

LIC’s quarterly and annual financial reports, including premium collections, claim settlements, and profit margins, play a major role in determining investor sentiment and share price movements. -

Brand Trust and Customer Base

LIC’s strong brand reputation and massive policyholder base give it a competitive edge. Continuous customer trust and an expanding portfolio of insurance products can contribute to long-term share price appreciation.

Risks and Challenges for LIC Share Price

-

Strong Market Competition

LIC faces tough competition from private insurance companies like HDFC Life, SBI Life, and ICICI Prudential. If customers prefer private insurers due to better services or higher returns, LIC’s market share and stock price may be affected. -

Government Influence and Policy Changes

Since LIC is a government-backed entity, any policy decisions regarding dividend payouts, stake dilution, or regulations can impact its financial health and stock performance. Sudden policy changes may create uncertainty for investors. -

Investment Risks

LIC invests heavily in the stock market and government bonds. If these investments underperform due to economic downturns or market volatility, LIC’s profitability may decline, negatively affecting its share price. -

High Claim Settlements

If LIC has to settle a large number of claims due to unforeseen events like pandemics or natural disasters, it could put financial pressure on the company, leading to a decline in earnings and investor confidence. -

Slow Business Growth

As private insurers introduce innovative products and digital services, LIC may struggle to keep up if it doesn’t modernize quickly. Slow adaptation to market trends could lead to a decline in new policy sales, impacting share price growth. -

Macroeconomic Factors

Inflation, interest rates, and GDP growth directly affect LIC’s business. A weak economy can lower customer purchasing power, reducing demand for life insurance policies and affecting LIC’s revenue and stock value. -

Regulatory and Compliance Challenges

The insurance industry is subject to strict regulations. Any new compliance requirements, taxation rules, or restrictions on investment options could impact LIC’s operations and profitability, leading to stock price fluctuations.

Read Also:- RVNL Share Price Target Tomorrow 2025 To 2030