HDFC Bank Share Price Target Tomorrow 2025 To 2030

HDFC Bank is one of India’s largest and most trusted private sector banks. It is known for its strong financial performance, customer-friendly services, and consistent growth. The bank operates in retail banking, corporate banking, and digital banking, making it a key player in the Indian financial sector.

HDFC Bank’s shares are widely traded in the stock market and are considered a stable investment due to the bank’s solid fundamentals, strong management, and expanding customer base. HDFC Bank Share Price on NSE as of 21 March 2025 is 1,767.25 INR.

Current Market overview of HDFC Bank Share Price

- Open: 1,755.55

- High: 1,772.95

- Low: 1,755.55

- Previous Close: 1,768.75

- Volume: 4,197,172

- Value (Lacs): 74,216.49

- VWAP: 1,764.42

- Mkt Cap (Rs. Cr.): 1,353,050

- Face Value: 1

- UC Limit: 1,945.60

- LC Limit: 1,591.90

- 52 Week High: 1,880.00

- 52 Week Low: 1,421.25

HDFC Bank Share Price Target Tomorrow 2025 To 2030

| HDFC Bank Share Price Target Years | HDFC Bank Share Price |

| 2025 | INR 1900 |

| 2026 | INR 2200 |

| 2027 | INR 2500 |

| 2028 | INR 2800 |

| 2029 | INR 3100 |

| 2030 | INR 3400 |

HDFC Bank Share Price Chart

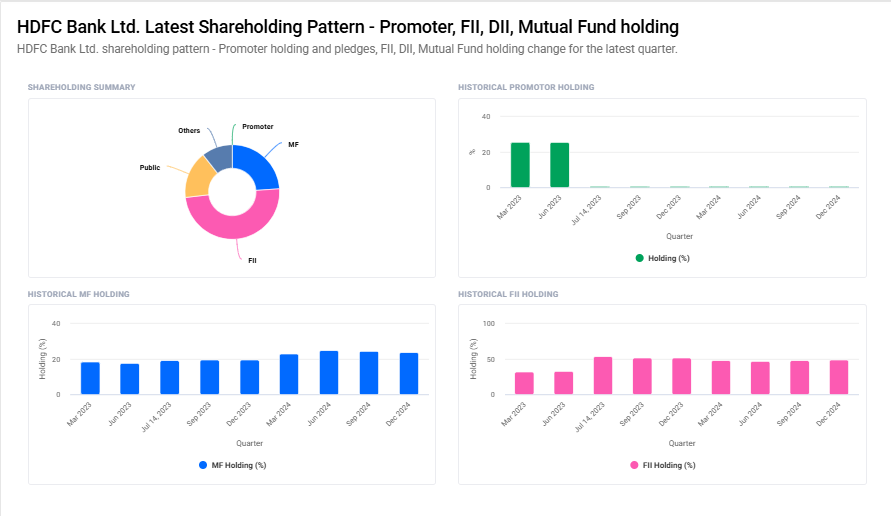

HDFC Bank Shareholding Pattern

- Promoter: 0%

- FII: 49.2%

- DII: 34.6%

- Public: 16.2%

Key Factors Affecting HDFC Bank Share Price Growth

-

Strong Financial Performance

HDFC Bank consistently delivers strong earnings growth, stable profit margins, and low non-performing assets (NPAs). Investors closely watch its quarterly results, and strong financials often boost share prices. -

Loan Book Expansion

The bank’s ability to grow its loan portfolio across retail and corporate segments plays a big role in share price growth. Higher credit demand and responsible lending practices contribute to steady earnings. -

Interest Rate Trends

Changes in interest rates impact the bank’s net interest margin (NIM). When rates are favorable, HDFC Bank earns better profits from lending, positively influencing its stock price. -

Digital Banking Growth

HDFC Bank has been a leader in digital banking, with strong mobile and internet banking services. Expansion in fintech and digital payment solutions helps attract more customers, driving growth. -

Economic Conditions

A growing economy leads to increased business activity, higher loan demand, and better repayment rates. If the economy remains strong, HDFC Bank benefits, leading to share price appreciation. -

Foreign and Institutional Investments

HDFC Bank is a preferred stock among foreign institutional investors (FIIs) and domestic mutual funds. High investor confidence leads to strong demand for its shares, supporting price growth. -

Regulatory Environment

Banking regulations by the RBI, such as capital requirements, lending policies, and interest rate caps, impact growth. A stable and supportive regulatory environment helps the bank expand without hurdles.

Risks and Challenges for HDFC Bank Share Price

-

Regulatory Changes

The banking sector is highly regulated by the Reserve Bank of India (RBI). Any changes in policies related to interest rates, lending limits, or capital requirements can impact HDFC Bank’s profitability and stock performance. -

Rising Non-Performing Assets (NPAs)

If borrowers fail to repay loans on time, the bank’s NPAs can increase, leading to higher provisioning costs and lower profits. A rise in bad loans may negatively affect investor confidence and share prices. -

Economic Slowdown

A weak economy can reduce loan demand and impact business growth. Slow economic activity can lead to higher defaults and lower banking revenues, putting pressure on the stock price. -

Intense Competition

HDFC Bank faces strong competition from other private banks, public sector banks, and fintech companies. If it fails to innovate or retain customers, it may lose market share, affecting its financial performance. -

Interest Rate Fluctuations

Changes in interest rates directly affect HDFC Bank’s net interest margin (NIM). If rates rise sharply, borrowing costs can increase, and if they fall too much, the bank may earn less from loans, impacting profitability. -

Global Market Uncertainty

Foreign investments play a big role in HDFC Bank’s stock movement. Global factors like inflation, recession fears, or geopolitical tensions can lead to foreign investors pulling out funds, causing stock price volatility. -

Cybersecurity and Technological Risks

As HDFC Bank relies heavily on digital banking, cybersecurity threats, data breaches, or system failures can impact customer trust and lead to reputational damage. Any major disruption can affect stock sentiment.

Read Also:- NHPC Share Price Target Tomorrow 2025 To 2030