Piramal Pharma Share Price Target Tomorrow 2025 To 2030

Piramal Pharma is a well-known pharmaceutical company involved in drug manufacturing, contract development, and healthcare solutions. The company operates in both domestic and international markets, focusing on specialty pharmaceuticals, active pharmaceutical ingredients (APIs), and consumer healthcare products. Piramal Pharma Share Price on NSE as of 18 March 2025 is 207.77 INR.

Current Market overview of Piramal Pharma Share Price

- Open: 206.20

- High: 209.00

- Low: 205.35

- Previous Close: 205.93

- Volume: 1,357,771

- Value (Lacs): 2,821.04

- VWAP: 207.40

- Mkt Cap (Rs. Cr.): 27,545

- Face Value: 10

- UC Limit: 247.11

- LC Limit: 164.74

- 52 Week High: 307.90

- 52 Week Low: 118.25

Piramal Pharma Share Price Target Tomorrow 2025 To 2030

| Piramal Pharma Share Price Target Years | Piramal Pharma Share Price |

| 2025 | INR 310 |

| 2026 | INR 415 |

| 2027 | INR 509 |

| 2028 | INR 605 |

| 2029 | INR 710 |

| 2030 | INR 812 |

Piramal Pharma Share Price Chart

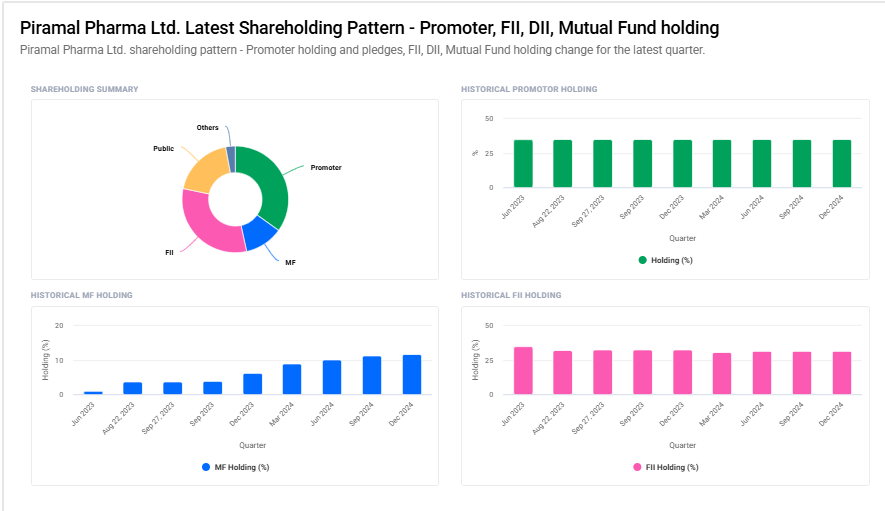

Piramal Pharma Shareholding Pattern

- Promoter: 35%

- FII: 31.7%

- DII: 14.4%

- Public: 18.9%

Key Factors Affecting Piramal Pharma Share Price Growth

-

Revenue and Profit Growth

Consistent growth in revenue and profits strengthens investor confidence. Expansion in domestic and global markets, new product launches, and efficiency improvements can drive the company’s earnings, positively impacting its share price. -

New Drug Approvals and R&D Innovations

Investment in research and development (R&D) for new medicines, successful clinical trials, and regulatory approvals can significantly boost growth. Strong innovation gives the company a competitive edge and attracts long-term investors. -

Expansion in Global Markets

Piramal Pharma’s ability to expand its presence in international markets, especially in the U.S. and Europe, can drive higher sales and profitability. Strategic partnerships and acquisitions also play a key role in global expansion. -

Regulatory Compliance and Certifications

Maintaining high-quality standards and securing approvals from global regulatory bodies like the U.S. FDA and WHO enhances the company’s reputation. A strong compliance record helps build trust and reduces risks related to legal or operational issues. -

Growing Demand for Healthcare and Pharmaceuticals

Rising healthcare awareness, increasing demand for medicines, and growth in the pharmaceutical sector benefit the company. The expansion of generic drugs and contract manufacturing services can further support share price growth. -

Cost Management and Operational Efficiency

Controlling production costs, improving supply chain efficiency, and managing raw material expenses contribute to higher margins. Effective cost management ensures sustainable profitability, which positively influences stock performance. -

Market Sentiment and Institutional Investments

Investor sentiment, market trends, and interest from large institutional investors can drive stock price movement. Positive analyst ratings and increased institutional holdings boost confidence in the company’s growth potential.

Risks and Challenges for Piramal Pharma Share Price

-

Regulatory and Compliance Risks

The pharmaceutical industry is highly regulated, and any failure to meet quality standards set by global authorities like the U.S. FDA or WHO can lead to fines, bans, or recalls. Such issues can hurt the company’s reputation and negatively impact its share price. -

Pricing Pressure and Competition

The pharma market is highly competitive, with pressure to keep drug prices low. Generic drug makers and new market entrants can reduce profit margins, making it harder for Piramal Pharma to maintain high earnings growth. -

Dependence on Key Markets

A significant portion of revenue comes from key markets like the U.S. and Europe. Any regulatory changes, trade restrictions, or geopolitical tensions in these regions can affect sales and profitability. -

Raw Material and Supply Chain Disruptions

Piramal Pharma relies on a steady supply of raw materials, often imported from other countries. Rising costs, supply chain disruptions, or geopolitical issues can increase expenses and impact profit margins. -

High R&D Costs and Uncertain Approvals

Developing new drugs requires heavy investment in research and clinical trials, with no guarantee of success. Failed trials or delays in regulatory approvals can result in financial losses and a decline in investor confidence. -

Debt and Financial Burden

If the company takes on excessive debt for expansion or acquisitions, it may lead to financial stress. High interest payments and borrowing costs can reduce net profits and limit growth opportunities. -

Market Volatility and Investor Sentiment

Stock prices can fluctuate due to broader market conditions, economic downturns, or negative news about the pharmaceutical sector. Any loss of investor confidence can lead to stock price declines, even if the company performs well operationally.

Read Also:- HCC Share Price Target Tomorrow 2025 To 2030