Surana Solar Share Price Target Tomorrow 2025 To 2030

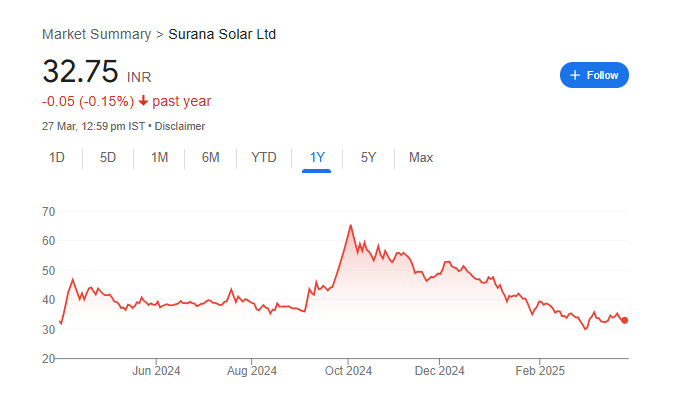

Surana Solar is a company involved in the manufacturing of solar panels and renewable energy solutions. Its share price is influenced by factors such as government policies, demand for solar energy, and raw material costs. Surana Solar Share Price on NSE as of 27 March 2025 is 32.75 INR.

Current Market overview of Surana Solar Share Price

- Open: 33.15

- High: 33.49

- Low: 32.70

- Previous Close: 33.00

- Volume: 73,711

- Value (Lacs): 24.11

- VWAP: 33.06

- Mkt Cap (Rs. Cr.): 160

- Face Value: 5

- UC Limit: 36.30

- LC Limit: 29.70

- 52 Week High: 65.38

- 52 Week Low: 28.46

Surana Solar Share Price Target Tomorrow 2025 To 2030

| Surana Solar Share Price Target Years | Surana Solar Share Price |

| 2025 | INR 70 |

| 2026 | INR 80 |

| 2027 | INR 90 |

| 2028 | INR 100 |

| 2029 | INR 120 |

| 2030 | INR 130 |

Surana Solar Share Price Chart

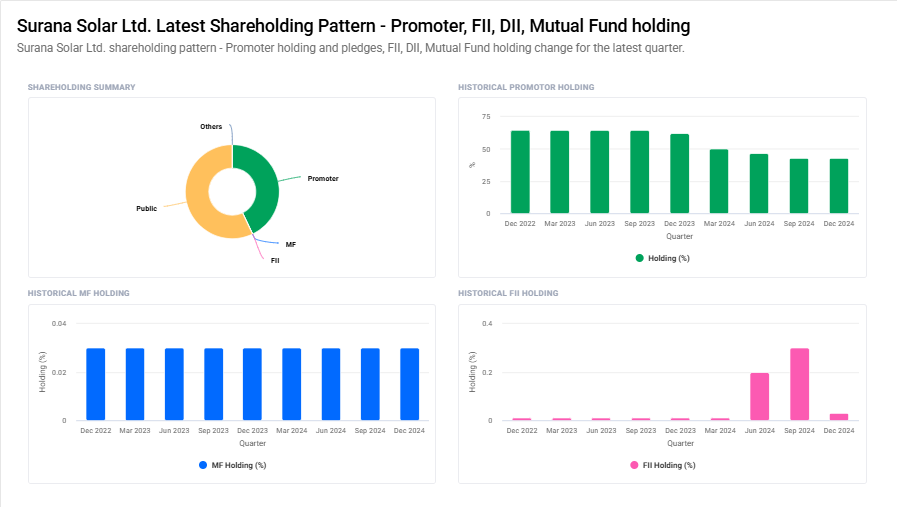

Surana Solar Shareholding Pattern

- Promoter: 42.9%

- FII: 0%

- DII: 0%

- Public: 57.1%

Key Factors Affecting Surana Solar Share Price Growth

-

Growing Demand for Solar Energy

As the world shifts towards renewable energy, the demand for solar panels and solutions is increasing. Government policies promoting clean energy and rising environmental awareness support Surana Solar’s growth potential, positively impacting its share price. -

Government Incentives and Policies

Policies such as subsidies, tax benefits, and incentives for solar energy adoption can directly benefit Surana Solar. Favorable government regulations can enhance profitability and drive long-term growth in the company’s stock. -

Expansion and New Projects

If Surana Solar expands its production capacity, enters new markets, or secures large projects, it can significantly boost investor confidence and drive share price growth. Partnerships and collaborations with other firms can also enhance business opportunities. -

Raw Material Costs and Supply Chain Stability

The availability and cost of essential raw materials like silicon and solar glass can affect production costs. A stable supply chain and cost-efficient procurement can help maintain profitability, positively influencing the stock price. -

Technological Advancements and Innovation

Continuous improvement in solar panel efficiency, battery storage, and innovative solar solutions can give Surana Solar a competitive edge. Investments in research and development can attract investors looking for future-ready companies. -

Financial Performance and Profitability

Strong revenue growth, improving profit margins, and reduced debt levels make a stock more attractive to investors. Regular positive financial results can lead to better stock performance over time. -

Global and Domestic Market Trends

The overall performance of the renewable energy sector, fluctuations in electricity demand, and global economic conditions play a crucial role in determining Surana Solar’s share price movement. A growing solar industry will likely benefit the company in the long run.

Risks and Challenges for Surana Solar Share Price

-

High Competition in the Solar Industry

The solar energy sector is highly competitive, with big players and new entrants constantly innovating. Larger companies with better technology and financial backing could impact Surana Solar’s market share, affecting its growth and stock price. -

Dependence on Government Policies

Solar energy companies rely heavily on government subsidies, tax incentives, and favorable regulations. Any changes or reductions in these policies could negatively impact Surana Solar’s revenue and share price. -

Raw Material Price Fluctuations

The cost of essential raw materials like silicon, glass, and metals used in solar panels can be volatile. Rising material costs can increase production expenses, reducing profit margins and putting pressure on the stock price. -

Supply Chain Disruptions

Delays in importing or sourcing raw materials, logistical challenges, or global trade restrictions can disrupt production. Supply chain issues can lead to delays in project execution and impact revenue growth. -

Slow Adoption of Solar Energy in Some Markets

While solar energy is growing, its adoption rate varies across regions. If demand slows due to high installation costs or a lack of infrastructure, it could limit Surana Solar’s revenue growth and affect investor confidence. -

Financial Performance and Profitability Concerns

If Surana Solar struggles with low margins, high debt, or inconsistent earnings, it may create uncertainty among investors. Weak financial performance can lead to lower valuations and reduced stock price stability. -

Technological Advancements by Competitors

Rapid improvements in solar technology by other companies could make Surana Solar’s products less competitive. If the company fails to keep up with innovation, it may lose market share, impacting its long-term growth potential and stock performance.

Read Also:- Power Grid Share Price Target Tomorrow 2025 To 2030