NLC Share Price Target Tomorrow 2025 To 2030

NLC India Limited (NLC) is a government-owned company engaged in lignite mining and power generation. It plays a key role in India’s energy sector, supplying electricity to multiple states. The company is also expanding into renewable energy to reduce dependence on coal-based power. NLC shares attract investors due to its stable business model, government backing, and long-term growth potential. NLC Share Price on NSE as of 27 March 2025 is 242.40 INR.

Current Market overview of NLC Share Price

- Open: 243.10

- High: 246.67

- Low: 241.60

- Previous Close: 241.92

- Volume: 973,470

- Value (Lacs): 2,359.79

- VWAP: 244.47

- Mkt Cap (Rs. Cr.): 33,613

- Face Value: 10

- UC Limit: 290.30

- LC Limit: 193.53

- 52 Week High: 311.80

- 52 Week Low: 186.03

NLC Share Price Target Tomorrow 2025 To 2030

| NLC Share Price Target Years | NLC Share Price |

| 2025 | INR 315 |

| 2026 | INR 335 |

| 2027 | INR 350 |

| 2028 | INR 370 |

| 2029 | INR 390 |

| 2030 | INR 410 |

NLC Share Price Chart

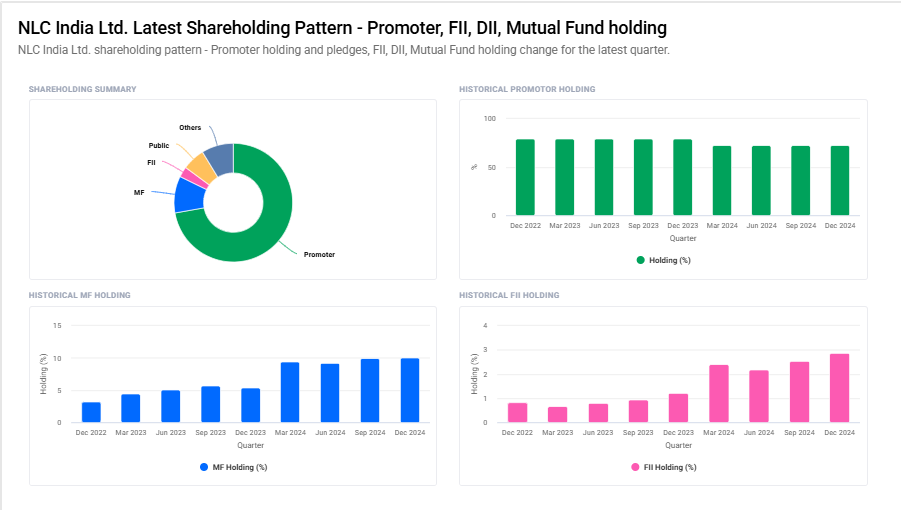

NLC Shareholding Pattern

- Promoter: 72.2%

- FII: 2.9%

- DII: 18.8%

- Public: 6.2%

Key Factors Affecting NLC Share Price Growth

Risks and Challenges for NLC Share Price

-

Dependence on Government Policies

Since NLC is a government-owned company, its operations are highly influenced by government regulations, coal policies, and environmental laws. Any unfavorable policy changes can impact its profitability and stock price. -

Fluctuations in Power Demand

NLC’s earnings depend on electricity consumption. If industrial demand slows down or alternative energy sources like solar and wind become more dominant, the company’s revenue could be affected, leading to stock price volatility. -

Operational and Production Challenges

Lignite mining and power generation involve high costs and operational risks. Any delays in project execution, technical failures, or accidents in mines can disrupt production and negatively impact earnings. -

Transition to Renewable Energy

While NLC is expanding into renewables, the shift from lignite to clean energy is challenging. High capital investment, competition from private players, and policy changes in the renewable sector could slow down growth and affect investor sentiment. -

Coal Price and Supply Risks

Though NLC mainly uses lignite, any disruption in coal supply chains, price hikes, or restrictions on coal-based power plants could impact operations, raising concerns for investors. -

High Debt Levels and Financial Risks

Large infrastructure and power projects require heavy investments, leading to increased debt. If NLC fails to manage its borrowings effectively, it may face financial strain, affecting profitability and share performance. -

Market Sentiment and Competition

Investor sentiment plays a crucial role in stock movement. If other power sector companies show better growth or attract more investments, NLC’s share price could face pressure due to increased competition and shifting investor interest.

Read Also:- GMR Power Share Price Target Tomorrow 2025 To 2030