Trident Share Price Target Tomorrow 2025 To 2030

Trident Limited is a well-known Indian company engaged in textiles, paper, and chemicals. It is a major player in the home textiles segment, producing bed and bath linen, and also manufactures high-quality paper. The company exports its products globally, making it an important player in the export market. Trident Share Price on NSE as of 27 March 2025 is 24.74 INR.

Current Market overview of Trident Share Price

- Open: 24.62

- High: 24.97

- Low: 24.39

- Previous Close: 24.62

- Volume: 5,155,686.00

- Value (Lacs): 1,277.06

- VWAP: 24.71

- Mkt Cap (Rs. Cr.): 12,623

- Face Value: 1.00

- UC Limit: 29.54

- LC Limit: 19.69

- 52 Week High: 42.05

- 52 Week Low: 23.90

Trident Share Price Target Tomorrow 2025 To 2030

| Trident Share Price Target Years | Trident Share Price |

| 2025 | INR 45 |

| 2026 | INR 55 |

| 2027 | INR 65 |

| 2028 | INR 75 |

| 2029 | INR 85 |

| 2030 | INR 95 |

Trident Share Price Chart

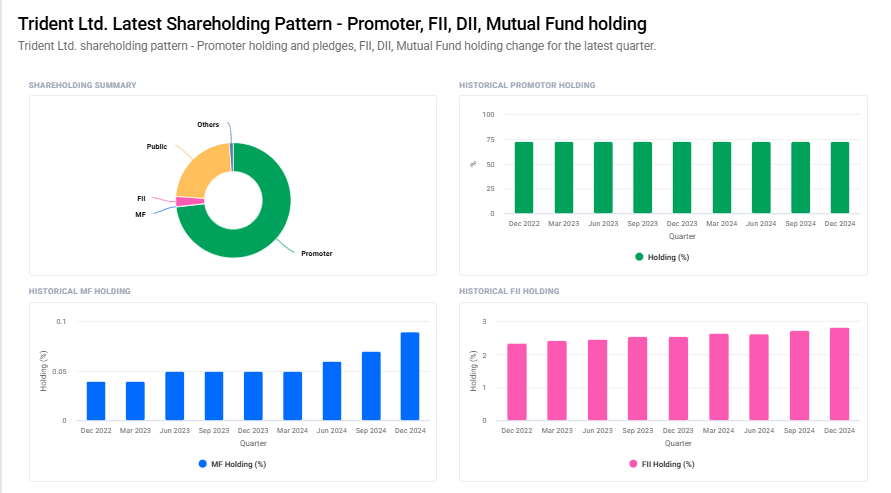

Trident Shareholding Pattern

- Promoter: 73.2%

- FII: 2.8%

- DII: 0.1%

- Public: 23.9%

Key Factors Affecting Trident Share Price Growth

-

Strong Demand for Home Textiles & Paper Products

Trident is a major player in home textiles, paper, and chemicals. Growing demand for luxury and eco-friendly home products, especially in international markets, can boost the company’s revenue and share price. -

Export Growth & Global Expansion

The company exports to multiple countries, and any increase in global demand or expansion into new markets can positively impact its financial performance and stock price. -

Raw Material Price Fluctuations

Cotton and pulp are key raw materials for Trident. If raw material costs remain stable or decline, it can improve profitability, leading to better investor confidence and stock growth. -

Government Policies & Support

Policies supporting textile and paper industries, such as subsidies, export incentives, or tax benefits, can help the company grow, making its stock more attractive to investors. -

Product Innovation & Sustainability Initiatives

Trident focuses on sustainable manufacturing and innovative products, like eco-friendly towels and paper. These initiatives align with global trends and can drive higher sales and stock appreciation. -

Financial Performance & Profit Margins

Steady revenue growth, profitability, and strong balance sheets improve investor trust. If Trident consistently reports strong earnings, its share price is likely to rise. -

Market Sentiment & Economic Conditions

Overall market trends, inflation, interest rates, and consumer spending habits impact Trident’s stock. Positive economic conditions and a strong textile sector can drive share price growth.

Risks and Challenges for Trident Share Price

-

Raw Material Price Volatility

Trident depends on cotton and pulp for its textile and paper divisions. Any rise in the prices of these raw materials can increase costs, reduce profit margins, and negatively impact its share price. -

Global Economic Slowdown

If major markets like the US and Europe face economic downturns, demand for textiles and paper products could decline. This could lead to lower revenues and affect investor confidence in Trident’s stock. -

Intense Market Competition

The textile industry is highly competitive, with both domestic and international players. Strong competition can limit Trident’s pricing power, impacting its sales and profitability. -

Foreign Exchange Fluctuations

Since Trident exports a significant portion of its products, fluctuations in currency exchange rates can impact revenue and profit. A weaker rupee benefits exports, while a stronger rupee may reduce earnings from foreign markets. -

Regulatory & Environmental Compliance

Stricter environmental regulations and policies related to sustainable production can increase costs. Any non-compliance could lead to penalties or restrictions, affecting the company’s operations and stock price. -

Dependence on Consumer Preferences

Changes in fashion trends or consumer preferences can impact demand for home textiles. If Trident fails to innovate or meet changing customer needs, it may lose market share. -

Stock Market Volatility

Broader market conditions, inflation, interest rate hikes, or geopolitical events can impact investor sentiment. Even if Trident performs well, external factors could lead to fluctuations in its share price.

Read Also:- GVK Power Share Price Target Tomorrow 2025 To 2030