GMR Power Share Price Target Tomorrow 2025 To 2030

GMR Power is a part of the GMR Group, involved in power generation and infrastructure development. The company operates thermal, solar, and hydropower plants, supplying electricity to industries and state utilities. Its stock performance depends on factors like fuel costs, government policies, and power demand. GMR Power Share Price on NSE as of 26 March 2025 is 109.55 INR.

Current Market overview of GMR Power Share Price

- Open: 108.99

- High: 110.95

- Low: 108.68

- Previous Close: 108.99

- Volume: 999,772

- Value (Lacs): 1,095.25

- VWAP: 109.76

- Mkt Cap (Rs. Cr.): 7,831

- Face Value: 5

- UC Limit: 130.78

- LC Limit: 87.19

- 52 Week High: 169.25

- 52 Week Low: 42.25

GMR Power Share Price Target Tomorrow 2025 To 2030

| GMR Power Share Price Target Years | GMR Power Share Price |

| 2025 | INR 170 |

| 2026 | INR 240 |

| 2027 | INR 300 |

| 2028 | INR 360 |

| 2029 | INR 420 |

| 2030 | INR 480 |

GMR Power Share Price Chart

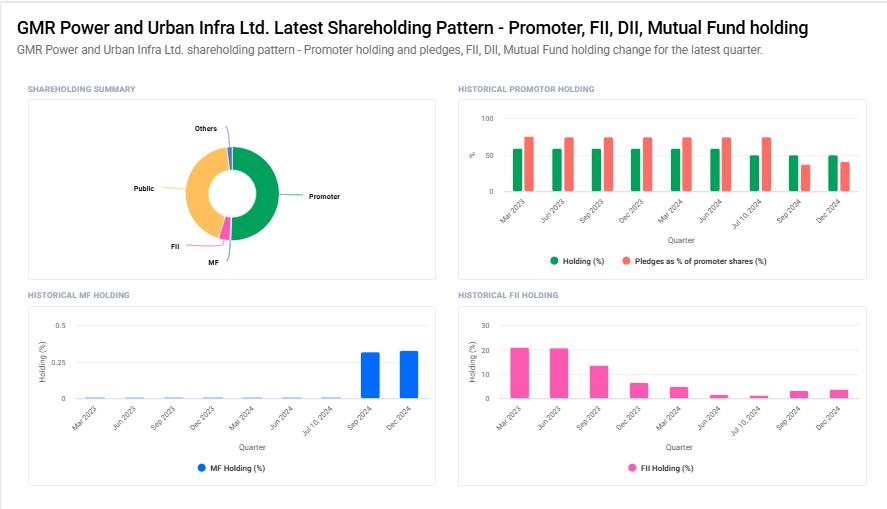

GMR Power Shareholding Pattern

- Promoter: 50.5%

- FII: 4%

- DII: 2.3%

- Public: 43.2%

Key Factors Affecting GMR Power Share Price Growth

-

Expansion in Power Projects

GMR Power is actively expanding its energy generation capacity through new projects. Successful completion and commissioning of these projects can boost revenue and positively impact the share price. -

Government Policies & Support

The government’s focus on infrastructure and renewable energy can provide incentives and support for power companies like GMR, improving business prospects and investor confidence. -

Increase in Power Demand

Growing industrialization, urbanization, and rising electricity consumption can drive higher demand for power, benefiting GMR Power’s revenue and share price. -

Debt Management & Financial Health

Managing debt efficiently and maintaining profitability is crucial. Lower interest costs and improved cash flow can strengthen investor sentiment and push the share price higher. -

Long-Term Power Purchase Agreements (PPAs)

Stable and long-term PPAs with industrial and commercial customers ensure steady revenue inflows, reducing risks and enhancing the company’s valuation in the stock market. -

Renewable Energy Investments

As the world shifts toward green energy, GMR’s investments in solar, wind, and other renewable sources can attract investors focused on sustainable businesses, improving its stock performance. -

Macroeconomic & Market Conditions

Factors like GDP growth, inflation rates, and global energy prices can influence investor confidence in the power sector, impacting GMR Power’s share price movements.

Risks and Challenges for GMR Power Share Price

-

High Debt Levels

GMR Power has significant debt obligations. If the company struggles to manage repayments or interest costs rise, it could impact profitability and investor confidence, leading to share price volatility. -

Regulatory & Policy Changes

The power sector is highly regulated. Any unfavorable government policies, changes in tariffs, or new environmental laws can affect the company’s operations and financial performance. -

Fluctuations in Fuel Prices

Rising coal, gas, or other fuel costs can increase operational expenses, reducing profit margins. If GMR cannot pass these costs to customers, it may negatively impact earnings and stock value. -

Project Delays & Cost Overruns

Delays in setting up new power plants, infrastructure projects, or cost overruns due to supply chain issues and regulatory approvals can affect revenue projections and investor sentiment. -

Competition in the Power Sector

The Indian power sector is highly competitive, with major players like NTPC, Tata Power, and Adani Power. Intense competition can limit market share growth and pressure profit margins. -

Dependence on Power Purchase Agreements (PPAs)

GMR’s revenue depends largely on PPAs with state and industrial consumers. If these contracts are not renewed or revised at lower tariffs, it could impact earnings and share price performance. -

Economic & Market Uncertainty

Factors like economic slowdown, inflation, or global financial instability can reduce industrial power consumption and investor interest in the power sector, affecting GMR Power’s stock movement.

Read Also:- Va Tech Share Price Target Tomorrow 2025 To 2030